What Is The Signifigance Of Sending Money Home Economics

An explanation of what happens if there are net outflows of coin from a land. Bear upon on:

- Real GDP (tends to fall)

- Employment

- Exchange charge per unit – exchange charge per unit will autumn

- Balance of Payments – debit on financial account

- Conviction – if big outflows it can cause a negative screw of failing confidence.

- Government debt – it can be more hard to finance authorities borrowing from overseas investors.

It depends whether the outflow of money is small or acquired by a loss of confidence (capital flight)

Bear on of 'hot money flows'

Suppose interest rates in one state are very low. This will crusade investors to look away for better returns on savings.

If United kingdom interest rates are nix, savers become a poor return, so they may wait to invest in other countries where interest rates are college. If involvement rates in the U.s.a. are three%, it would make sense for a saver to deposit money in US banks (or purchase US bonds).

This causes financial flows out of the UK into the US. Information technology is a debit item on the fiscal account balance of payments.

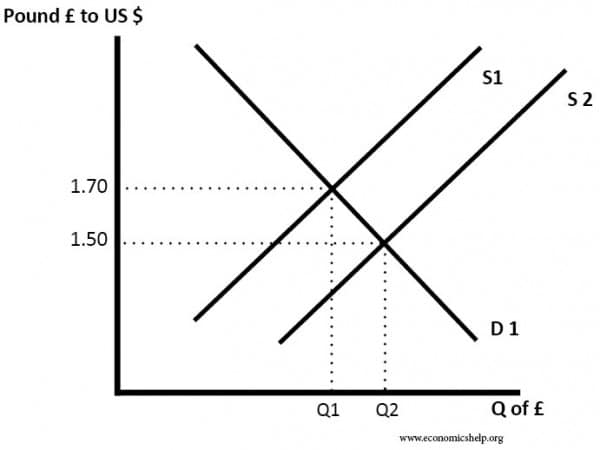

Impact on exchange rate of upper-case letter outflows

If in that location is a large net outflow of money, and then nosotros volition await to see a depreciation in the exchange rate. This is because people will sell Sterling in social club to purchase Dollar assets. The increase in the supply of Sterling on foreign exchange markets volition depress the value of the Pound Sterling.

Outflow of money from U.k. causes value of Pound to fall from £1 = $one.seventy to £i = $1.50

- The impact of a depreciation in Pound Sterling volition tend to crusade inflation.

- Information technology volition brand imports more than expensive, causing a rise in price of imported goods.

- We say there is a turn down in the terms of trade – consumers tin can buy fewer imported goods/compared to exports.

- The depreciation in the exchange rate will besides make exports cheaper, causing a rise in export demand (and higher Aggregate Demand. This rise in export need can lead to new jobs in exporting industries and a higher charge per unit of economical growth.

- Therefore, if there is a moderate depreciation in the exchange rate, it can boost economical growth.

See more: impact of depreciation in commutation rate

Affect on Amass Demand of uppercase outflows

If we see a significant outflow of savings from the UK to U.s.a., it will have only a minimal impact on UK aggregate demand.

People will tend to motility savings – rather than cash earmarked for spending.

It will tend to be wealthy people and big investment funds who move savings to the Usa. For the average consumer, it is not worth shifting £ten,000 of savings from the Britain to the The states, simply because interest rates are marginally higher. Therefore, these short-term hot money flows don't take a significant impact on spending and investment because it is but moving savings from one country to another.

Withal, if there is a crunch of conviction and many ordinary people try to shift their coin out of the economic system (fearing rapid devaluation) then it will outset to impact domestic demand. WIth coin leaving the economy – in that location will be less demand for domestic goods.

Capital flying

Hot money flows tend to be adequately short-term. If nosotros get temporary outflows of capital, it might have limited impact on the economic system. However, if nosotros get large and sustained capital outflows, information technology could start to have an adverse affect on domestic investment. If banks come across a decline in cash reserves, they have less money to lend for investment. A big drib in the savings ratio would take an touch on on investment in the country which is experiencing capital letter flight. For case, countries similar Russia and Venezuela which relied on oil revenues – saw sharp capital outflows when the price of oil barbarous. This caused serious problems for these economies. The currency savage rapidly and it acquired high inflation.

Turn down in confidence

If general consumers lost all confidence in a particular country, they may desire to put all their savings abroad. This big fall in conviction could lead to uppercase flight – with a decline in investment and ordinary spending levels. This kind of capital flight can cause a fall in economical growth. For example, Hellenic republic has suffered capital letter flying and this is a factor in the Greek recession. Only, this level of capital flight was not acquired past lower interest rates, but large structural problems, such as thrift and a collapsing economic system.

Impact of capital outflows on the rest of payments

As mentioned hot money flows are counted as part of the financial component of the remainder of payments. It is an outflow from the fiscal account.

In a floating exchange rate, the financial account / current business relationship must balance. Then a bigger deficit on the financial account volition need a surplus on the current account.

What volition happen is that with lower interest rates nosotros get a depreciation in the currency. The depreciation volition brand exports cheaper and imports more expensive. This will tend to better the current account balance (exports increment, imports decline) and this offsets the fiscal outflows.

Readers Question: Generally, one would say that a decrease in interest rates boosts demand and has an inflationary effect, every bit people & corporations tin can borrow more cheaply. However, ane too frequently reads that, in times of low interest rates, money often "flees" the country, looking for better returns elsewhere – east.grand. developing countries. I would presume that money leaving the land has a deflationary event. How do these two explanations work together?

You are right that cut interest rates, ceteris paribus, tends to cause rise demand, higher inflation and higher economic growth.

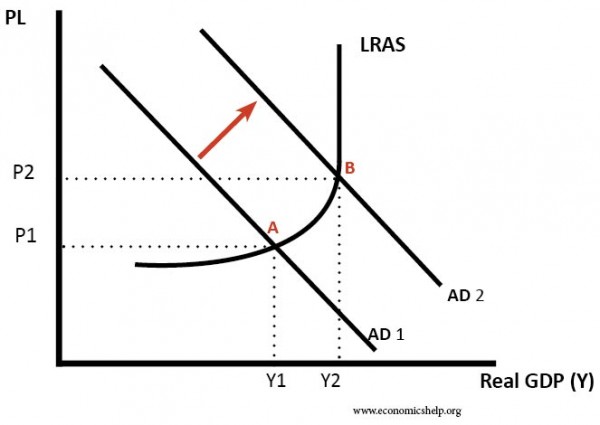

Lower interest rates reduce the cost of borrowing, encouraging firms to invest and consumers to spend. In add-on, there are other transmission mechanisms – lower interest rates, reduce the cost of mortgage repayments – giving householders more disposable income to spend. These combined factors tend to cause rise aggregate demand, higher growth and higher inflation.

Bear on on Advertisement/As of cutting interest rates

Lower interest rates help to cause rising Ad, this leads to higher inflation.

See more detail – impact of lower interest rates

Source: https://www.economicshelp.org/blog/14264/economics/impact-of-money-leaving-the-economy/

Posted by: skeltonsonters.blogspot.com

0 Response to "What Is The Signifigance Of Sending Money Home Economics"

Post a Comment