Can Debt Collector Take Money My Bank Account

A collection bureau must have a judgment against you to take money from your account.

There are few occurrences more discouraging than the discovery that a drove agency is afterward you for an declared unpaid debt. What can exist even more alarming is the fact that this drove agency removed money from your bank account in an try to secure payment. While this may seem unjust, especially when you lot have other bills to pay, there are situations where information technology is perfectly legal.

Collection Agency

It's important to understand that the purpose of a collection agency is to collect unpaid debts. Typically, this is on behalf of your original creditor, who hires the drove bureau to do the dirty piece of work. You may also run into attorneys who specialize in collection law working to collect debts for their clients. Another possibility is that the collection agency purchased a number of unpaid debts at low cost and is attempting to collect on them for its own profit.

Legality

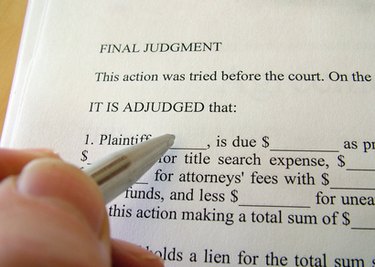

Under Federal Law, a drove agency or debt collector tin only withdraw money from your bank account if information technology obtains a judgment against you. According to Section 809 of the Fair Debt Collection Practices Human action, the collection agency must first requite you 30 days, through written notice to accept care of the debt. Following the xxx days, the collection agency must file a lawsuit and the court must rule in its favor, placing a judgment against y'all. Then, and just then, can the collection agency place a garnishment on your bank business relationship. The garnishment procedure varies from state to country.

Exemptions

Most government benefits in your bank business relationship are exempt from garnishment including: social security benefits, Supplement Security Income benefits, federal retirement and disability benefits, federal student aid loans, military annuities and survivors' benefits, and veteran's benefits. Additionally, child back up payments, life insurance benefits and workers bounty benefits are exempt from garnishment. However, it's important to notation that drove companies may garnish these funds if the purpose is to pay delinquent taxes, dorsum child back up, alimony or for paying back student loans.

Considerations

While it is rare, there may be occasions when a collection agency unjustly takes coin from your bank business relationship. If it is due to garnishment of exempt funds, y'all may need to hire an attorney to assistance you in "quashing" -- releasing -- the garnishment. In the very to the lowest degree, you need to provide proof to the courtroom that the funds in your business relationship are exempt.

If the unjust garnishment of your account is because the collection agency does not have a court judgment confronting you, then you can file a lawsuit. You must exercise so within a year from the date the agency garnished your business relationship. If the court finds in your favor, you may receive reimbursement of the funds every bit well equally up to $1,000 or more in damages, attorney fees and court costs. However, you volition still owe the coin on the unpaid debt.

Source: https://www.sapling.com/7987108/can-agencies-money-bank-account

Posted by: skeltonsonters.blogspot.com

0 Response to "Can Debt Collector Take Money My Bank Account"

Post a Comment